By dev March 5, 2025

You must also increase the 15-year safe harbor amortization period to a 25-year period for certain intangibles related to benefits arising from the provision, production, or improvement of real property. For this purpose, real property includes property that will remain attached to the real property for an indefinite period of time, such as roads, bridges, tunnels, pavements, and pollution control facilities. If you can depreciate the cost of a patent or copyright, use the straight line method over the useful life. The useful life of a patent or copyright is the lesser of the life granted to it by the government or the remaining life when you acquire it.

What’s The Difference? Property Management vs Accounting Software for Real Estate

Maintains a live WIP by connecting financial data with real project context from PM updates, daily logs, and conversations. Builds accurate cost-plus and fixed-price billings directly from approved job costs with backup https://www.lagrangenews.com/sponsored-content/real-estate-bookkeeping-how-it-powers-your-business-488ddc68 attached and nothing missed. Missing or miscoded costs do not quietly accumulate in the background. Continuously captures and codes every cost including bills, receipts, cards, and payments to the correct job and cost code as work happens.

Property Owned or Used in 1986

You are an inspector for Uplift, a construction company with many sites in the local area. Uplift does not furnish an automobile or explicitly require you to use your own automobile. However, it pays you for any costs you incur in traveling to the various sites. The use of your own automobile or a rental automobile is for the convenience of Uplift and is required as a condition of employment.

Which Performance Reports Are Essential for Real Estate Financial Reporting?

- This use of company automobiles by employees, even for personal purposes, is a qualified business use for the company.

- A number of years that establish the property class and recovery period for most types of property under the General Depreciation System (GDS) and Alternative Depreciation System (ADS).

- If you only looked at Table B-1, you would select asset class 00.3, Land Improvements, and incorrectly use a recovery period of 15 years for GDS or 20 years for ADS.

- Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications.

- For ERPs and Accounting Systems, we offer a fully managed AP infrastructure, eliminating the need for you to build, maintain, or scale complex AP automation workflows.

- We don’t intend to provide any wrong information through this website.

- “It has been an excellent way of tracking expenses all in one app. I had considered using AppFolio, but that was too complicated for me.”

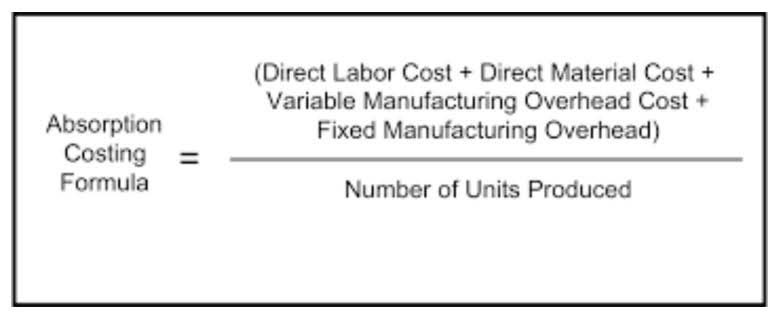

Calculate all direct and indirect costs, including construction materials, labor, permits, and contingency expenses. Financial data from accounting helps project managers make informed decisions on resource allocation and scheduling. Transparent accounting builds trust with investors and stakeholders by showing how funds are used.

Entrata puts essential data at your fingertips to help you maximize utility expense recapture, accelerate property cash flow, and generate new ancillary revenue. The unified dashboard that aggregates real-time financial data, lease details, and tenant interactions, eliminating the need for multiple tools. Modern all-in-one tool for landlords providing accounting automation for rent tracking, maintenance expenses, profit/loss statements, and 1099 generation. Make tax filing easy and claim every deduction for a more profitable rental portfolio. Real Estate Bookkeeping: How It Powers Your Business Share financial reports with investors to demonstrate performance and build confidence. Clear reporting ensures stakeholders understand the project’s financial position and progress.

By dev February 14, 2025

Real estate accounting includes sensitive bank data, owner information, and contracts. Small to mid-sized commercial property managers and owners needing an all-in-one solution for accounting, leasing, and operations without enterprise-level complexity. Cloud lease accounting software automating IFRS 16 and ASC 842 compliance for commercial real estate assets. Lease administration and accounting software ensuring ASC 842 compliance for commercial real estate portfolios.

- Reading the headings and descriptions under asset class 30.1, you find that it does not include land improvements.

- If you use property for business or investment purposes and for personal purposes, you can deduct depreciation based only on the business or investment use.

- The maximum deduction amounts for trucks and vans are shown in the following table.

- Billings reflect real work completed, go out on time, and get approved with fewer questions because the documentation already supports the numbers.

Propertyware Cons

Between multi-entity accounting, intricate lease structures, and varied ownership percentages, generic software often falls short. That’s why specialized property management tools have become essential; they automate repetitive tasks, improve data accuracy, and provide a clear view of your financial and operational performance. Cloud property management software with integrated general ledger accounting, AP/AR, and financial reporting for investors. Comprehensive enterprise platform for Why Professional Real Estate Bookkeeping Is Essential for Your Businesses real estate property management, fund accounting, investor distributions, and portfolio reporting. CRM and operations platform with fund accounting tools designed for alternative asset managers including real estate.

Step 5: Handle Terminations & End-of-Lease Accounting

Capitalization and depreciation schedules –Whether pre-fabricated for capital project capitalization or handled automatically by the system, improved accuracy in long-term asset accounting is a benefit. Starts at $0/month for up to 3 units (Starter), $59/month for up to 10 units (Growth), $99+/month for larger portfolios (Pro/Premium); additional fees for premium features. By consolidating your chart of accounts into STRATAFOLIO, you create an effective, scalable accounting structure that drives better decisions and sustainable growth.

The Taxpayer Advocate Service (TAS) Is Here To Help You

Missing or miscoded costs do not quietly accumulate in the background. AI operates across your existing systems, turning disconnected workflows into one continuous financial process. Starts at $58/month for Essential plan (up to 20 units), with Growth ($175/month for 50 units) and Premium tiers scaling by units and features; annual discounts available. Custom enterprise pricing, typically starting at $100,000+ annually based on portfolio size and modules, with significant implementation fees.

Detailed Chart of Accounts

The secure investor portal enables limited partners to access real-time data, documents, and personalized reporting, streamlining GP-LP communications. This comparison table showcases leading real estate accounting software tools, including AppFolio, Yardi, Buildium, Entrata, MRI Software, and more, to assist real estate professionals in evaluating options. Readers will gain insights into key features, pricing structures, and usability to identify the best fit for managing property finances. Here are five specialized real estate accounting software that address these needs with comprehensive features designed specifically for property management. Propertyware is designed for the unique needs of single-family rental businesses.

Tara treats this property as placed in service on the first day of the sixth month of the short tax year, or August 1, 2024. You reduce the adjusted basis ($288) by the depreciation claimed in the fourth year ($115) to get the reduced adjusted basis of $173. You multiply the reduced adjusted basis ($173) by the result (66.67%). You multiply the reduced adjusted basis ($480) by the result (28.57%). For property for which you used a half-year convention, the depreciation deduction for the year of the disposition is half the depreciation determined for the full year.

What Is Qualified Property?

- If an account is not used much, you should consider rolling it into another.

- Users can also generate key financial reports, helping them make informed decisions about their investments.

- See Certain Qualified Property Acquired After September 27, 2017 and Certain Plants Bearing Fruits and Nuts under What Is Qualified Property?

- The recovery period of property is the number of years over which you recover its cost or other basis.

- Therefore, you cannot elect a section 179 deduction or claim a special depreciation allowance for the item of listed property.

The second https://www.blogstrove.com/categories/business/how-real-estate-bookkeeping-drives-success-in-your-business/ quarter begins on the first day of the fourth month of the tax year. The third quarter begins on the first day of the seventh month of the tax year. The fourth quarter begins on the first day of the tenth month of the tax year. Depreciate trees and vines bearing fruits or nuts under GDS using the straight line method over a recovery period of 10 years.

In chapter 4 for the class lives or the recovery periods for GDS and ADS for the following. If it is described in Table B-1, also check Table B-2 to find the activity in which the property is being used. If the activity is described in Table B-2, read the text (if any) under the title to determine if the property is specifically included in that asset class. If it is, use the recovery period shown in the appropriate column of Table B-2 following the description of the activity. You will need to look at both Table B-1 and Table B-2 to find the correct recovery period. Generally, if the property is listed in Table B-1, you use the recovery period shown in that table.

By dev October 14, 2024

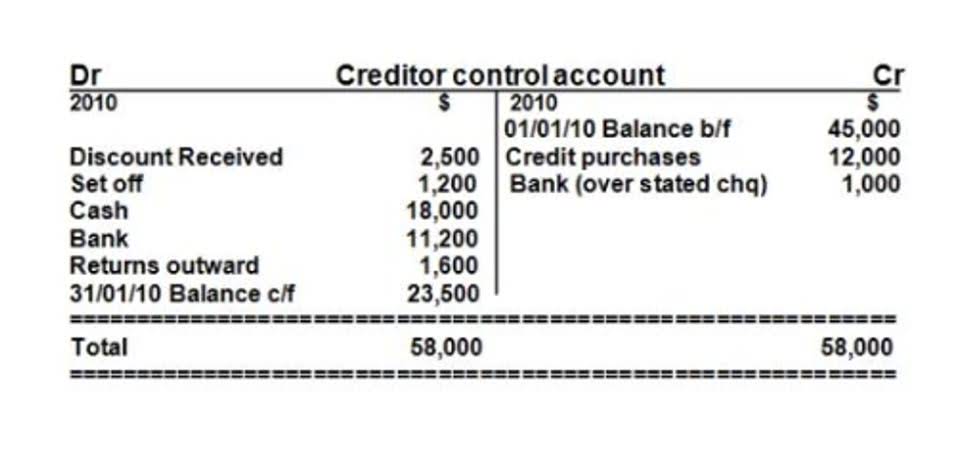

The numbers in your company’s financial statements show the overall picture but reveal only a glimpse of the full story. All debit entries are placed on the left side of the T-account, and all credit entries are placed on the right side of the T-account. Add up all the debit entries to find the total debits, and add up all the credit entries to find the total credits. Then subtract the total debits from the total credits; if the result is positive, the account has a debit balance, and if the result is negative, the account has a credit balance. This double-entry balances the T-accounting equation, with total debits equal to total credits. The purpose of journalizing is to record the change in the accounting equation caused by a business event.

T accounts FAQ

Most income summary business owners understand just how important financial forecasting is. Because T-accounts rely on manual input, they need careful review to ensure accuracy. In this example, the business has decided to pay rent for the next quarter. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Minneapolis Mayor Says He Spoke With Trump and the President Agreed the ‘Situation Can’t Continue’

You told me about the expense account, but what other account or accounts are involved? ” Thanks to his two T-accounts, I have never forgotten to consider the full impact of business transactions. T-accounts, in contrast, are visual tools used to analyze how transactions impact individual accounts. Shaped like a “T,” they separate debits (left side) and credits (right side) to show how each entry alters a specific account’s balance. Journal entries are the official, chronological records of all financial transactions.

Take advantage of these offers to switch to T-Mobile

The following T-account examples provide an outline of the most common T-accounts. It is impossible to provide a complete set of examples that address every variation in every situation since there are hundreds of such T-accounts. The visual presentation of journal entries, which are recorded in the general ledger account, is known as the T-Account.

The balance sheet summarizes the financial position of the company at the end of a specific period, usually at the end of the fiscal year. It is used by stakeholders to evaluate a company’s financial strength and to make investment decisions. This prepaid £6,000 represents an asset because the landlord owes the business 3 months usage of their property t account example rent has been paid in advance. As the business will be paying for the coffee machine in the following month, the accounts payable is increased (credited) by £700. While T-accounts help visualize transaction flow, ledgers are the authoritative source used in reports and audits.

- By visually separating different accounts, T-accounts help businesses and auditors understand financial flows at a glance.

- I begin by drawing two T-accounts, marking one as the balance sheet account, and one as the income statement account.

- Without proper management of cash flow, a business simply cannot survive.

- By recording the debit and credit halves of the transaction and then running a trial balance, the accountant can be sure that nothing has been missed.

- Debits and credits can mean either increasing or decreasing for different accounts, but their T Account representations look the same in terms of left and right positioning in relation to the “T”.

- Let’s break down the basics of debit and credit entries with some clear examples using T-accounts.

- That’s why we constantly offer different ways to get a free or zero-down cell phone from awesome brands, like Apple, Samsung, and Google.

Debits and Credits for T Accounts

For more insights, visit our accounting general journal entries. T-accounts also help manage income statement accounts like revenues, expenses, gains, and losses. Knowing how these entries affect the income statement is crucial for financial analysis. A revenue account represents increases in economic benefits from the ordinary activities of the business (sales revenue, service revenue). T Accounts allows businesses that use double entry to distinguish easily between those debits and credits.

T-Mobile customer benefits

As I stated before, some accounts will have multiple transactions, so it’s important to have a place number each transaction amount in the debit and credit columns. Using T Accounts, tracking multiple journal entries within a certain period of time becomes much easier. Every journal entry is posted to its respective T Account, on the correct side, by the correct amount. These entries are recorded as journal entries in the company’s books. When most people hear the term debits and credits, they think of debit cards and credit cards.

Credit Card Features

This T format graphically depicts the debits on the left side of the T and the credits on the right side. This system https://travelrelatedservices.com/bookkeeping-services-salt-lake-city-ut-premium/ allows accountants and bookkeepers to easily track account balances and spot errors in journal entries. A single-entry accounting system records each financial transaction only once, which does not provide enough detail for the T-account’s visual format. In contrast, a double-entry system records every transaction twice—once as a debit and once as a credit—allowing T-accounts to separate and display these entries.

Have a complete view of your finances, accept local currencies and payment types for a smooth checkout experience. Shopify Balance is a free financial account that lets you manage your business’s money from Shopify admin. Pay no monthly fees, get payouts up to seven days earlier, and earn cashback on eligible purchases. T Accounts always follow the same structure to record entries – with “debits” on the left, and “credits” on the right.

By dev November 8, 2023

Expense reporting software streamlines how businesses track, record, and manage their spending. Our guide includes platforms that integrate with popular accounting systems, offer great value, and suit companies of all sizes. Expensify is generally better for small businesses for comprehensive expense management. If your main need is automated document collection to feed into your accounting software, Hubdoc could be a strong choice.

Notable Features

- With a free bank account through Relay, businesses gain access to a range of features from accounts payable to expense management.

- It updates your accounting software automatically when your business gets paid.

- It built its expense management services with global teams in mind, boasting features like payments in any currency and reimbursement in more than 100 countries.

- The company’s core services include detailed bookkeeping, tax preparation, and CFO advisory that works well for growing businesses.

- Salesforce CRM has powerful built-in tools that help any startup keep track of prospects, clients, and customers organized and efficiently.

- Incorrectly categorizing expenses can result in inaccurate financial reports and missed tax deductions.

Every Expensify plan also includes automatic mileage tracking, basic bill management, and invoicing. The free business plan adds corporate card access via the Expensify Card, as well as employee expense reimbursement. The mobile app allows you to manage expenses, scan receipts, and generate reports from Streamline Your Finances with Expert Accounting Services For Startups anywhere. I loved the convenience of being able to handle my expenses while traveling, ensuring that I never missed a receipt or lost track of my spending. It’s a powerful tool for busy professionals who need to stay organized on the move.

Escalon Services

- Forecasting allows you to predict revenue, expenses, and cash flow over a specific period.

- The integration saves valuable time and resources by eliminating manual data entry, reducing errors, and enhancing compliance, giving you more time to nurture talent and accelerate growth.

- Effective human resources are key to attracting top talent, retaining valued employees, and creating a positive work environment.

- It is important that all financial information submitted to the IRS is accurate.

- Chamber of Commerce notes, founders who try to do everything themselves can easily mismanage finances, and bringing in help (like a fractional CFO) can significantly improve outcomes.

- Each package comes with fixed monthly rates disclosed upfront without hidden fees.

On the platform, businesses can set receipt policies for employees to ensure they always meet proof of purchase requirements and compliance standards. Additionally, the platform documents each receipt so it’s ready in case of an Internal Revenue Service (IRS) audit. Expensify’s interface has a slightly higher learning curve than some users (especially those new to accounting and expense tracking) would like.

Step 3: Integrate Automation Early

Digital accounting tools are all but essential in today’s competitive landscape, with 71% of small business owners now using accounting software to manage their finances. However, with countless options available, it’s challenging to identify the best products and services to meet your needs. We collaborate with you to set up a budget (even if it’s rough at first) and a dynamic financial model for your business. If you don’t have a model yet, we’ll build one that fits your business drivers – for SaaS startups, we’ll incorporate things like MRR, CAC, churn; for marketplaces, maybe GMV and take rates, etc. We also update the budget vs. actuals so you can see how reality compares to forecasts and adjust course.

Connect company cards from 10,000+ banks worldwide for automatic receipt matching and reconciliation. Try Expensify today and streamline your businesses expenses from start to finish. With QuantiFi as your partner, you gain clarity, strategy, and confidence in every stage of growth – without the overhead. Free up your time to innovate, while our experts handle the books and guide your financial decisions. Schedule your free startup https://dimensionzen.com/streamline-your-finances-with-expert-accounting-services-for-startups/ consultation today ➜ and let’s build your unicorn on a solid financial foundation. The Control plan is bundled with the Expensify Visa® Commercial Card and costs $9/user per month (annual commitment).

#5 Bank of America Business Advantage Unlimited Cash Rewards

From payroll taxes to sales tax, failing to plan can result in penalties. Setting aside a portion of revenue for tax payments is a smart strategy. Falling behind can lead to inaccuracies and make tax season a nightmare.

By dev October 21, 2022

Additionally, inaccurate or inconsistent bookkeeping for trust accounts may lead to regulatory penalties and damage the firm’s reputation. Law firms often choose to hire professional accountants or bookkeepers who understand things like client trust accounts so that everything with money stays safe and correct. Each month, a team of professional bookkeepers with experience in legal accounting gathers your data for you and turns it into accurate financial statements. You also get smart software to help you monitor your finances and stay in control of cash flow. In addition to their business checking and savings accounts, most law firms are required to hold client funds in a separate trust account—often called an “IOLTA”.

Bookkeeping and Administrative Services

This enhances the Visibility of the firm’s true profitability to partners and stakeholders. We help firms avoid artificially inflating profit by correctly handling interim payments and potential abatements. Generic billing tools fail to address the The Importance of Expert Bookkeeping for Law Firms unique workflows of legal practices, leaving attorneys struggling to track billable hours, manage fixed fees, and generate precise invoices.

Mid-sized firms

- This information can help you plan your strategy and make more informed decisions.

- It is crucial for law firms to adhere to meticulous record-keeping practices and keep separate accounts as required by state bar association rules.

- Bill4Time allows you to create professional invoices from detailed time entries, apply matter-specific rates, manage payments securely, and much more.

- Audit triggers often involve late reconciliations, missing client ledgers, or discrepancies in balances.

- According to bar association reports, most compliance failures result from incomplete records or delayed reporting.

- No, legal services in the UAE are generally standard-rated at 5% VAT with very few exceptions.

It is shaped by ethical obligations such as the ABA Rule 1.15, which mandates the separation of client funds from a law firm’s operating funds. Regulatory bodies closely monitor compliance, and even small errors can have severe consequences. Did you know that over 30% of law firms faced compliance penalties last year due to errors in legal accounting? As regulations tighten and financial processes grow more complex, law firms must navigate a landscape filled with unique challenges and high stakes.

- It is crucial to maintain meticulous record-keeping and to keep separate accounts, especially for trust accounting as required by state bar association rules.

- Even if you work with a bookkeeper or CPA, having a working knowledge of law firm accounting processes allows you to make better decisions about billing, budgeting, and trust account management.

- This contributes to why the general accounting principles (GAAP) does not find cash accounting acceptable.

- According to recent bar association reports, a significant portion of law firm disciplinary cases stem from accounting violations.

- Settlement funds pass through trust accounts without VAT application; only the firm’s professional fees are taxed.

Immigration Add-On That Gives You Time Back

A strategic approach to AI has allowed these firms to increase caseload, focus on advanced analysis, and deliver exceptional value to clients. Stay up-to-date on breaking developments in the law and legal industry, including Law360. Search the web to help contextualize legal findings within timely business, social, or regulatory trends. Prompt Protégé to draft legal documents based on uploaded materials or through the document management system (DMS) integration. We provide bespoke training to fee earners and finance staff on the correct procedures for time recording and bill preparation, ensuring claims are robust and compliant before they are submitted. This includes instruction on using LAA Claim Forms effectively and ensuring proper documentation for disbursements.

The Next Chapter in Legal Tech Innovation: Introducing Protégé

Furthermore, leveraging online tools such as Clio’s Accounting Hub for law firms can provide valuable insights and guidance on best practices in legal accounting. Failing to make this distinction can lead to compliance issues and inaccurate financial records, impacting the firm’s reputation and potential for growth. Running a law firm requires more than strong advocacy and successful case outcomes. Behind every thriving legal practice is a solid financial foundation built on law firm accounting. Unlike traditional small business accounting, law firm finances involve client trust accounts, strict compliance https://www.yuks.co/law/the-primary-aspects-of-bookkeeping-for-law-firms/ requirements, and ethical rules unique to the legal profession. Strategic financial planning in legal accounting goes beyond simple cost tracking.

Stay up-to-date on breaking developments in the law and legal industry, all in one place. Lexis+ AI DMS Integration acts as an intelligent layer that extracts information and insights from existing DMS systems documents, such as iManage, SharePoint, and others. Securely save a collection of documents for legal analysis and drafting tasks. Collaborate with Protégé in real time through the Guided Research structured workflow, designed in collaboration with legal experts to arrive at the highest-quality responses to legal inquiries. Create full drafts, accelerate legal research, and surface meaningful insights using both internal knowledge bases and industry-leading LexisNexis resources. Create a wide variety of communications and documents to support stakeholders and clients using Protégé General AI.

Good recordkeeping is imperative for both financial transparency and legal compliance. With advanced features like trust accounting, built-in payments, mobile access, and CRM, TimeSolv helps you streamline operations without adding complexity. Bill4Time offers a free trial and a free demo, so you can explore all core features before committing. The trial doesn’t require a credit card, and you can use it with real clients and matters. Industry-leading attorney billing software like Bill4time helps legal professionals record time, track expenses, and invoice clients accurately.

- The firm’s financial accounts must be carefully structured to ensure accurate tracking of all financial activities, including trust accounts, operating accounts, and client funds.

- Depending on your needs, opening a money market account for savings might be a smart move.

- This includes managing operating accounts, handling client trust funds, tracking expenses, and ensuring all billing and reporting practices adhere to legal and ethical standards.

- Every state has an IOLTA program, and it’s likely that the bank where you opened your regular business checking account also offers IOLTA accounts.

- It also aids in complying with regulatory requirements and protects the reputation of the firm by ensuring transparency and accountability in financial matters.

Law Firm Accounting & Bookkeeping A 2026 Guide

When performing accounting for law firms, it’s important to have a grasp on the basics. Below is a list of standard accounting terms and their definitions to better familiarize yourself with accounting practices for your law firm. These are detailed accounts for each client, tracking all financial activity related to their case. Ledgers include retainer fees paid, billable hours worked, expenses incurred on the client’s behalf, and invoices sent.

When a law firm submits a bill, the LAA may assess and reduce the claim due to insufficient evidence, non-compliant time recording, or exceeding fixed fees. Expect more from your legal practice management software with Smokeball’s advanced legal features. The complexity and dual regulatory risk (SRA and HMRC) inherent in law firm M\&A necessitate the involvement of specialists who understand the legal sector’s unique financial mandates.

By dev November 2, 2021

By reducing complexity and enhancing visibility, Cobase transforms payments from a back-office task into a forward-driving force for growth, control, and competitive advantage. While it’s easy to transact one-on-one, continuously paying a high volume requires a method known as bulk payments (also called mass payments, payouts, and batch payments). B2B ACH transfers are particularly popular for bulk payments because they offer a cost-effective way to process large volumes. A bulk fund transfer is another term for a bulk payment, referring to the process of transferring funds from a single account to multiple beneficiary accounts simultaneously.

- Instead of handling each payment separately, you can combine hundreds or thousands of payments into one streamlined operation.

- Businesses often need to make payments to multiple suppliers or vendors simultaneously.

- Once approved, the bulk payment system processes the transaction, debiting the payor’s account and crediting the beneficiaries’ accounts simultaneously.

- While individual transactions are simple enough, managing large-scale disbursements regularly needs something more reliable.

- Bulk payments are done through a digital mode that involves techniques such as Secure Sockets Layer (SSL).

- An Interpolitan Money account is not covered by the Financial Services Compensation Scheme (“FSCS”).

Enhanced Financial Transparency

Traditional banks have strict account-opening eligibility criteria based on residency, citizenship, minimum assets and income. If your company is a start-up, an SME or the UK branch of a foreign entity, you might find it very hard to open unearned revenue a domestic bank account. This blog explains ideal timing, best practices, and tips to get paid faster. It’s also best practice to take your time and communicate with your clients that this switch is being made. It lets them know to flag any issues to you and that you’re ready to work through them to find the solution. Imagine if instead of writing 15 checks for 15 outstanding invoices you could pay them all in one fell swoop.

Key Features of Bulk Payment Systems

This is perfect for small businesses that are managing a global team, saving a ton of time and hassle when making payments. Bulk payments are also prone to errors, such as insufficient funds, invalid account numbers, or bounced checks, which can cause delays in the process. When paying in bulk, it saves hours of individual sales calculations which facilitates operations and streamlines finances. Still, it’s a faster means of transacting then doing it bulk payment by each employee. When making the same bulk payment for payroll each month, it’s much easier to catch mistakes and discrepancies. Bulk payments will cost you a lot less than sending individual payments.

What are Bulk Payments

Considering that these savings happen every month, making the change to bulk payments pays dividends in perpetuity down the line. The bulk payment system verifies the beneficiaries’ account details and the total payment amount. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments. In contrast, providers like Interpolitan cater for many different company structures, offering a range of alternative banking solutions that streamline processes.

- GoCardless automatically creates and sends all the necessary forms, doing all the heavy lifting for you.

- If you choose a platform that doesn’t fit naturally into the technology you’re already using, you may find yourself doing enough additional upkeep that it offsets any gains.

- Whether it’s salaries, vendor payments, incentives, or commissions, timely and error-free payouts are non-negotiable.

- If you’re looking for easier bill payment services for your business, bulk payouts could be a big part of that.

- A secondary meaning of batch processing specifically relates to credit card transactions.

- Because you can’t use this feature on the Basic plan – which has no monthly fee – you’ll need to pay charges of 30 USD USD a month4 to access the feature.

Bulk payment systems handle large volumes of sensitive payment information, making them a target for Payroll Taxes fraudsters and cybercriminals. Businesses must implement strong security measures and use secure payment platforms to mitigate these risks. If the payment data provided in the bulk list contains errors or inaccuracies, it can lead to failed or incorrect payments.

By dev June 23, 2021

This schedule divides the loan amount into uniform monthly payments to guarantee full repayment by the end of the term. Real estate depreciation is the recognition that assets deteriorate and lose value as they age. It is an accounting principle that involves allocating the cost of a building or property over multiple years rather than recognizing it all at once.

Services to meet your needs

There is the local investor seeking a hedge against inflation, the Egyptian Expatriate (Expats) looking for a home back in Cairo, and the GCC investor attracted by the devalued EGP and high rental yields. A real estate account takes responsibility for the financial aspects of the buying, selling, leasing, and renting of real estate properties. Also known as property accountants, this position also plays an important role for preparing documents for tax season.

Tenant Screening

Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return.

Establish a Chart of Accounts

QuickBooks Online allows you to customize, add, or How Real Estate Bookkeeping Drives Success In Your Business edit accounts easily. The first step is deciding how you’ll manage your books—whether you use accounting software or a spreadsheet. Consider your property volume, comfort with financial tracking, and need for automation. A growing rental business, for example, might quickly outgrow manual tracking and benefit from a cloud-based tool that can scale. A reliable bookkeeping service empowers you to make informed budgeting decisions, freeing up valuable time to focus on running your small business.

- That includes agents, brokers, landlords, investors, and property managers—all of whom need reliable financial systems to stay profitable and compliant.

- Deep-dives should focus on why something changed, not just that it changed.

- Bookkeeping in property management is the meticulous process of recording, organizing, and managing all financial transactions and records related to property management activities.

- Rentec Direct is a US-based company and all of their employees are located in the United States.

- We develop Standard Operating Procedures (SOPs) for property inspection, listing verification, and closing protocols, ensuring a “Global Standard” of service.

- Accurate income tracking is crucial for cash flow management, as it helps real estate professionals understand their revenue streams and ensure they have sufficient funds to cover operational expenses.

Artificial intelligence (AI) broadly refers to computer systems or software exhibiting human-like intelligence and automation capabilities. As machine learning and neural networks rapidly advance, AI tools now provide real estate agents meaningful assistance optimizing and even fully handling bookkeeping tasks. As assets used to produce income, rental properties can get depreciated over 27.5 or 39 years for residential buildings. Appliances, furniture, and improvements depreciate faster over 5-15 years. Bookkeeping needs to factor timeframes, depreciation methodology (straight-line most commonly), allowed deductions, and recaptured depreciation if sold.

A brokerage’s financial health depends on high-volume transactions and low overhead. Your financial model must account for the specific tax landscape of the Philippines. Like any other accounting practice, accounting in real estate is used for many reasons. One of the chief reasons is to provide an accurate and clear picture of the overall health of a business. Another reason is for tax purposes and to quickly assemble the required documents for an audit if one’s business is selected. Depending on how much you want to invest, most real estate agents turn to one of the following options for their accounts.

Real estate bookkeeping considerations by business model

Set up specific categories for income and expenses relevant to your real estate business, such as rental income, property maintenance, property management fees, etc. Real estate agents and other industry professionals face many problems. They are constantly communicating with tenants, prospective property owners, and clients, showing properties, and signing contracts. Delegating financial activities to https://backinsights.com/professional-real-estate-bookkeeping/ professionals allows them to sleep at night instead of sending invoices or reconciling accounts. A professional will organize your records, reconcile transactions, and generate reliable reports. Real estate businesses often rely on external funding and partnerships for growth and expansion.

Achieving Compliance with GAAP and IFRS in Real Estate Bookkeeping

- A winning Business Plan for Real Estate Brokerage Business in Phillipines in 2026 integrates PropTech (Property Technology) and localized high-touch service.

- They can identify cost-saving opportunities and monitor the financial health of their real estate business.

- Unlike many other service providers, Invasive is designed to meet the needs of property managers and real estate agents.

- Real estate agents can use financial reports to understand when cash will be coming in and when expenses need to be paid.

- Cloud accounting platform with bank feeds, multi-property tracking, and real estate-specific apps for seamless bookkeeping.

Real estate bookkeepingis a specialized branch of property accounting that involves the meticulous recording, organizing, and management of financial transactions related to real estate operations. Strategic management bookkeeping services encompass a range of financial management practices tailored to the unique needs of property businesses. These services are designed to provide property managers and real estate investors with accurate financial data, enabling them to make informed decisions that drive growth.

These insights will empower property managers to make informed decisions, identify potential revenue streams, and ultimately ensure the long-term financial health of their enterprises. They provide property owners with peace of mind, knowing that their investments are in capable hands, and tenants with a reliable point of contact for their housing needs. Effective property management is not just about managing spaces; it’s about creating thriving communities and fostering positive relationships between landlords and tenants.

By dev April 21, 2021

Proof of transparency surrounding financial records helps earn your client’s trust and confidence in your practice’s ability. We can help you select the optimal pricing model for specialty practices and develop competitive billing rates. What’s appropriate depends on how your firm operates and how much other firms in your practice specialty and/or geographic markets are currently charging. Hannah DeFreitas (née Bruno) is a Senior Content Strategist and Blog Specialist for 8am, a leading professional business solution, and a senior content writer for 8am. Her work spans long-form articles, thought leadership, product storytelling, and conversion copy that distills complex legal and fintech topics into clear, human language.

Trust accounting

Understanding what goes into accounting is essential; you still are not an accountant or a bookkeeper. Bringing in an expert will give you peace of mind knowing that your business will get tax seasons done right. Having people come in and help provide their expertise in accounting and bookkeeping will help you see that it is being taken care of accurately and ethically.

- As you gain experience, you will find the right balance that maximizes your profitability while offering fair value to your clients.

- In cash basis accounting, you record income and expenses when money changes hands.

- Of course, the line between bookkeeping and accounting can get blurred.

- Firms using legal practice management software like Clio or MyCase integrated with QuickBooks streamline bookkeeping workflows.

- Yet, for all this differentiation, firms generally collect the same hourly rate, right in line with the industry average, no matter what their strategy.

- Estate tracking software provides specialized functionalities crucial for efficient practice management.

Bookkeeping solutions

At least quarterly—ideally monthly—law firms must complete three-way trust account reconciliation. This is the process of reconciling your bank statement with your client trust account ledger and individual client ledgers. If statements don’t match, your firm must make corrections and ensure everything is accurately logged. Because of these differences, legal professionals need accounting systems and procedures tailored to the unique demands of the profession.

Types of Law Firm Expenses

Forecasting future income and expenses is a crucial part of budgeting. For law firm accounting and financial management, this process helps firms anticipate lean months, plan for tax liabilities, and avoid overspending. Managing law firm expenses is vital for understanding your firm’s financial health, optimizing profitability, and increasing lawyer compensation.

Legal accounting rules also require firms to maintain clear, detailed records that can withstand audits or regulatory reviews. This means going beyond basic bookkeeping to ensure that every transaction—from client retainers to settlement disbursements—is properly tracked and https://thebossmagazine.com/post/how-bookkeeping-for-law-firms-strengthens-their-finances/ documented. From reconciling trust accounts to staying IRS compliant, bookkeeping for lawyers isn’t something you should DIY, or outsource to a generalist. An in-house bookkeeper works directly within your firm, offering immediate support and a personal touch. Having someone in-house can be particularly beneficial when it comes to handling sensitive client billing and trust account management. However, this onsite service comes at a higher cost due to salaries, benefits, and office space considerations.

Ready to Finally Simplify Your Firm’s Bookkeeping?

- The crucial thing is to track the money collected from clients, known as the realization rate.

- Then, your accountant analyzes this data to identify slow-paying clients and recommend better billing policies.

- Take time to demo different options, involve your accounting team in the decision, and don’t hesitate to start with a more basic setup that you can expand as your firm grows.

- Additionally, understanding the distinction between cash and accrual accounting methods is vital for effective financial management in law firms.

- For example, keeping track of invoices or monthly recurring expenses.

- Learn the difference between a hard cost and soft cost below with examples, tracking tips, and an overview of how these expenses flow through your firm’s accounting and client billing process.

Here’s what you need to know to establish a reliable financial infrastructure for your law firm. Commingling is when a law firm mixes client funds with firm funds, either intentionally or by mistake. It’s a serious ethical violation that can result in bar sanctions, fines, and even disbarment. To avoid unintentional commingling, you must keep meticulous records, separate trust accounts, and regularly reconcile accounts. Every transaction in and out of these accounts must be properly recorded and documented. Mishandling trust/IOLTA accounts or reporting them incorrectly can lead to serious repercussions, including penalties, suspensions, and even disbarment.

By dev January 30, 2020

We’re looking for someone who meets the minimum requirements to be considered for the bookkeeping san francisco role. Pumpkin, a subsidiary of IPH, promises uncompromising care to the cats & dogs we love unconditionally. • Proficiency in Excel and accounting systems; experience with NetSuite is preferred. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Financial Management Accountant jobs

Safe Harbor LLP is a boutique accounting firm serving San Francisco-based businesses, high net worth individuals, and clients with international tax needs. The firm is focused on international tax, business & start-up tax, and finance. It offers tax preparations, international tax & accounting services, business partnerships, LLC tax returns, and estate planning. It also offers services for start-up companies, assisting them in setting up financial and tax systems, as well as stock options and tax planning opportunities. James J. McHale, CPA/PFS, is a family-owned accounting firm that serves San Francisco and the nearby areas.

Job Details

The Certified Sarbanes-Oxley Expert has worked with Fortune 500 companies. Spott, Lucey & Wall, CPAs, is an accounting firm located in San Francisco. Serving clients in and around the area, the firm provides a complete array of tax consulting and attestation services, including general accounting and business income tax. Its specific fields of expertise also include handling multiple areas of international tax.

Important Documents To Give Your Accountant for Tax Season

With a presence in every state, the team has a thorough understanding of the local accounting laws and regulations. Founded by seasoned CPAs who previously worked for international accounting firms, the firm brings a wealth of experience to support the financial needs of small businesses. Dimov Tax unearned revenue offers accounting solutions to personal and commercial clients in San Francisco. The firm audits, reviews, and compiles financial statements for small and larger businesses and conducts bookkeeping services. It provides taxation solutions for LLC entities, estates, and trusts.

Stripe is seeking an experienced accountant to join our world-class accounting team. Ideally you will have both public accounting and industry experience in tech or financial services, as well as experience working for companies with a high volume of complex transactions and issues. 1-800Accountant San Francisco provides financial services to small businesses in the local area. Its remote CPAs handle tax forms, such as 1040s, 1099s, and 1120s, for businesses involved in various industries like trucking, real estate, and e-commerce.

- Founded in 1991, the company comprises accounting and tax professionals who are dedicated to helping clients manage their financial matters.

- Determine which accountant best addresses your expectations and budget.

- You’ll play a critical role in ensuring accurate, scalable accounting for our rapidly growing music platform.

- It strives to provide easy access to clients’ accounts by making them available via their smartphones.

Junior Accountant jobs

Learn how an accountant for your small business can be the first step toward improving your business processes. Maximize your business’s financial success with bookkeeping basics and tools to manage your finances effectively. California is filled with talented accountants, which can make the hunt for the right one feel overwhelming.

• Conduct account reviews to verify accuracy and resolve discrepancies related to billing and How to Start a Bookkeeping Business payments. Prepare a standard set of questions that best address your business needs and speak to them to determine the right fit. You’ll receive ongoing help from bookkeepers who will respond to your calls within minutes.

- For more information about Expert Assisted, refer to the QuickBooks Terms of Service.

- Prepare a standard set of questions that best address your business needs and speak to them to determine the right fit.

- If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work.

- Experts add insights directly into each article, started with the help of AI.

- That means you have an unprecedented opportunity to put the global economy within everyone’s reach while doing the most important work of your career.

- • Oversee accounts receivable operations, ensuring timely collection and accurate application of payments.

- While both CPAs and accountants handle financial matters, CPAs have met specific state requirements, including passing the CPA exam.

This role requires working on-site 5 days a week in our SF or NYC office. This is a work from home position with location preference in the San Francisco/Bay Area, Los Angeles/Southern California, New York City, Austin, and Boston. Some travel to in-person company events is required, approximately 2-3 weeks out of the year. In-person onboarding training will take place within the first 3 months of employment (locations vary). • Excellent communication skills for effective interaction with both internal teams and external stakeholders. • Post cash receipts, adjustments, and refunds while adhering to standard accounting procedures.

Duties, responsibilities, and activities may change at any time with or without notice. • Customer service mindset and experience in accounts payable functions are advantageous. • Support month-end close activities, including revenue reconciliation and other financial processes.